Contents:

Income tax brackets are one of those financial systems that many people understand on the surface: a set of brackets (or ranges) that coincide with different levels of income that are used by governments to collect the appropriate amount of taxes from individuals. They’re also one of the systems that frequently get misunderstood: making enough additional money will cause you to move up into the next tax bracket and cost you more in taxes on that money than the amount of money itself.

This last part is false.

Yes, you’ll be paying more tax on that additional income but not so much as to negate all of the income. Tax rates are percentages of income so in order for that statement to be true, the tax rates in the new bracket would have to be 100% or more.

(Marginal) Tax Brackets

When we talk about tax brackets, we’re usually referring to marginal tax brackets which carry a rate of taxation that applies to every dollar from the bracket’s minimum amount up to its maximum. It only applies to income in that range – this is the important bit.

You live and work in the glorious country of SuperRegion earning a salary of $75,000. One afternoon your boss at work invites you into their office to award you a promotion and a salary bump of $30,000! Your new salary will put you into the $85,001-$110,000 tax bracket which has a tax rate of 27%.

Your old bracket ($1-$85,000) was only taxed at 16% so that means you’ll be paying $1,600 for the additional salary up to $85,000 ([$85,000 - $75,000] × 16% old tax bracket rate) and $5,400 for the additional salary in the new bracket ([$105,000 - $85,000.01] × 27%).

Altogether, this promotion will cost you an additional $7,000 ($5,400 + $1,600) in taxes but net you $23,000 more a year ($30,000 promotion - $7,000 in taxes) to save or spend!

The tax rate only applies to the money that falls within the associated tax bracket range. If you end up making one extra dollar that “moves you into the next tax bracket”, you only pay the new tax rate on that one dollar – the rest of your income is taxed at the previous bracket’s rates. Let’s look at a few example salaries using the actual 2021 federal tax rates in Canada.

| Tax bracket | Income range | Tax rate |

|---|---|---|

| 1 | $0 - $49,020 | 15% |

| 2 | $49,020.01 - $98,040 | 20.5% |

| 3 | $98,040.01 - $151,978 | 26% |

| 4 | $151,978.01 - $216,511 | 29% |

| 5 | $216,511.01+ | 33% |

| Salary | Taxation (Bracket 1) | Bracket 2 | Bracket 3 | Bracket 4 | Bracket 5 | Total Taxation | Average Tax Rate |

|---|---|---|---|---|---|---|---|

| $40,000 | $6,000 | 0 | 0 | 0 | 0 | $6,000 | 15% |

| $50,000 | $7,353 | $200.90 | 0 | 0 | 0 | $7,553.90 | 15.11% |

| $68,500 | $7,353 | $3,993.40 | 0 | 0 | 0 | $11,346.40 | 16.56% |

| $107,421 | $7,353 | $10,049.10 | $2,439.06 | 0 | 0 | $19,841.16 | 18.47% |

| $199,999 | $7,353 | $10,049.10 | $14,024.14 | $13,926.09 | 0 | $45,352.33 | 22.68% |

| $276,943 | $7,353 | $10,049.10 | $14,024.14 | $18,714.57 | $19,942.56 | $70,083.37 | 25.31% |

First thing to note: the taxation (money paid in tax) for certain brackets are the same between a few of the salaries even though some are higher than others. If a salary exceeds the maximum threshold of a bracket, the taxation will always be the same for that bracket since the bracket’s range never changes. This makes calculations easy because you only really need to worry about calculating the final bracket that the salary lands in – the previous ones will always use the maximum taxation for their bracket.

Second thing worth noting: the average tax rate in the final column of the table above. As the name implies, this is the average rate found by dividing the total taxation by the salary (taxes ÷ salary). This will always be lower than the marginal tax rate as it takes into account the lower rates of previous brackets and is more indicative of how much you’re relatively paying in taxes.

Final thing of note: this is an example using just the federal tax rate. Each province and territory in Canada has their own provincial income tax rate that is calculated the same way (but with different rates). The final amount of income tax payable for someone is the sum of both federal and provincial taxations. For example, in Ontario the rates are:

| Tax bracket | Income range | Tax rate |

|---|---|---|

| 1 | $0 - $45,142 | 5.05% |

| 2 | $45,142.01 - $90,287 | 9.15% |

| 3 | $90,287.01 - $150,000 | 11.16% |

| 4 | $150,000.01 - $220,000 | 12.16% |

| 5 | $220,000.01+ | 13.16% |

The calculation for the highest salary in the previous example ($276,943) using the Ontario rates above would be:

| Salary | Taxation (Bracket 1) | Bracket 2 | Bracket 3 | Bracket 4 | Bracket 5 | Total Taxation | Average Tax Rate |

|---|---|---|---|---|---|---|---|

| $276,943 | $2,279.67 | $4,130.77 | $6,663.97 | $8,512 | $7,493.70 | $29,080.11 | 10.5% |

This means someone with a salary of $276,943 in Ontario would pay $29,080.11 in provincial taxes and $70,083.11 in federal taxes (using the tax rates listed above) and their overall average tax rate (provincial and federal) would be 35.81% ($99,163.22 total taxation ÷ $276,943)1.

If you don’t feel like doing these calculations by hand, feel free to use a Canadian income tax calculator like this one, this one, or this one – the important things to understand are what tax brackets are and how income tax is calculated using them.

Marginal Tax Rate Applies to ALL Income?

As we’ve seen from the examples above, this is not true but the misunderstanding presented in the first paragraph stems from this. You may have read stories online or even heard firsthand accounts of people who have declined promotions and higher salaries because they feared the higher (marginal) tax rate brought on by the salary bump would cause their entire income to be taxed at that new rate.

If they weren’t aware of how tax brackets work and confused their marginal and average tax rates, then the thought process becomes a little clearer. Thankfully that’s not how it works and additional income is still worthwhile (short of it being taxed at 100%).

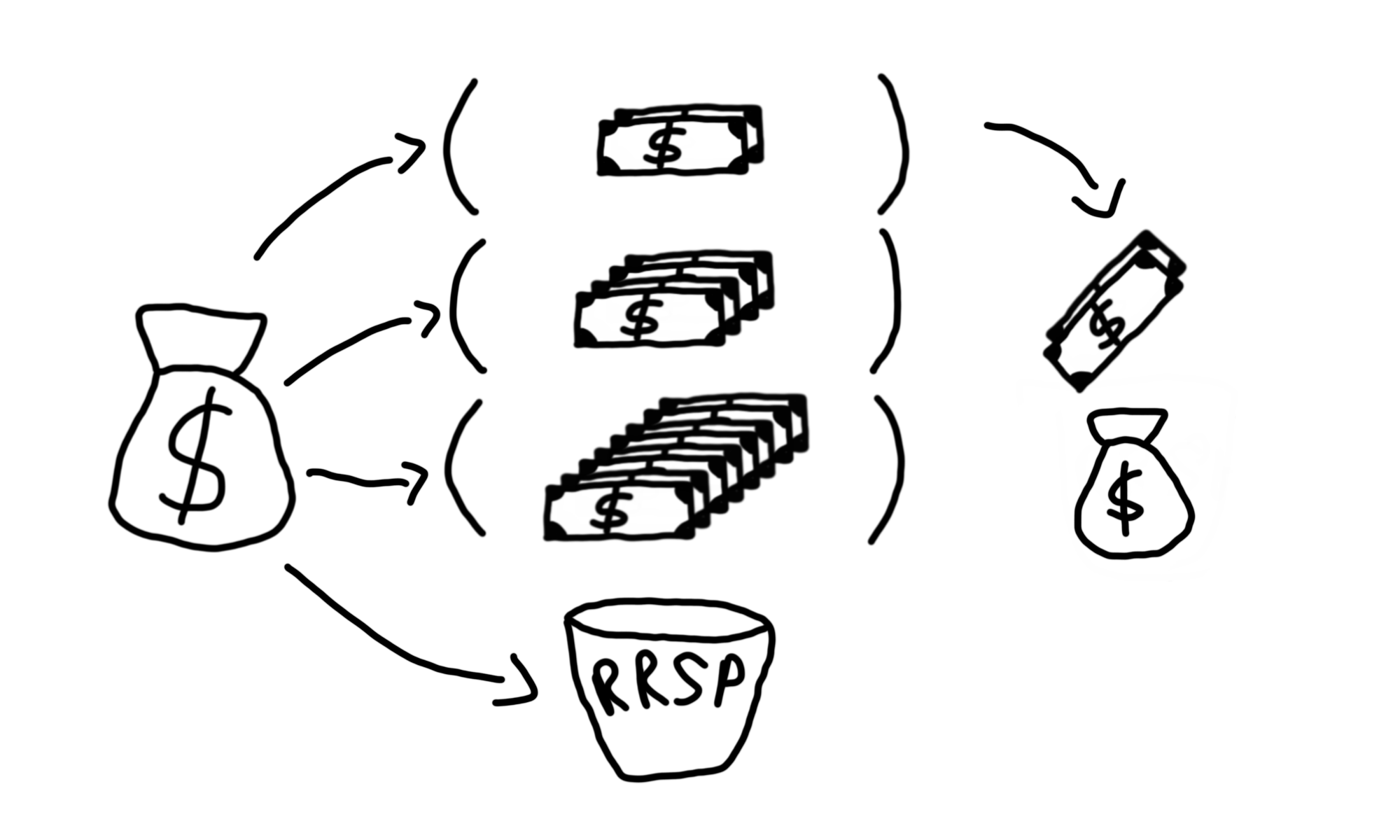

RRSP Contributions

As outlined in this post, contributions to your Registered Retirement Savings Plan (RRSP) can be made with after-tax dollars (money from your income after taxes have been collected from your employer – your net income) even though they affect your pre-tax income (your income before taxes are collected – your gross income).

This distinction is important because come tax time in April, RRSP contributions will reduce your pre-tax income which in turn will affect the amount of income tax you’ll actually owe. Your employer is not aware of these contributions when they deduct income taxes for you (their deduction happens before you contribute – they’d need to be time travellers or mind readers) which means that assuming you’ve made any contributions at all, they’ll have deducted too much.

Your employer SuperCo pays you $50,000 (pre-tax income) and deducts 15% for income taxes before they pay you the remaining $42,500 ($50,000 - $7,500 in taxes [$50,000 × 15%]).

You make a contribution of $5,000 to your RRSP which reduces your total pre-tax income to $45,000. When preparing your tax return, the software recalculates the amount of income tax you owe (with the same 15% rate) as $6,750 ($45,000 × 15%) which means your employer has deducted $750 too much ($7,500 - $6,750).

Tax Refund!

What happens in the above scenario when an employer has deducted too much money for your new pre-tax income level? If you’ve read that post linked above (or read the title of this section) you’ll know that you get a tax refund.

A tax refund is effectively the government acknowledging that you (or your employer on behalf of you) have paid too much in income taxes and they’re returning that money back to you.

Incentivizing Retirement Savings

Contributing to your RRSP is one of the most direct ways to reduce your tax burden (the amount of income tax you owe). Allowing these contributions to reduce that burden is how the government incentivizes or encourages people to save for their retirement.

A potential tax refund brought on by a lower pre-tax income (from RRSP contributions) is an immediate gain now for the individual but also a gain for them in the future when they have more money in their RRSP to live off of in retirement.

The policy around RRSP deductions is the government’s way of “forcing” people to contribute to (and maybe subconsciously think about) their retirement by “rewarding” them now with a potential tax refund 2.

In a world dominated by consumption and instant gratification, this may not be a bad idea.

TL;DR

Tax brackets are ranges of income that are taxed at different rates. Each bracket’s rate applies only to income in that range. If you end up making one extra dollar that “moves you into the next tax bracket”, you only pay the new tax rate on that one dollar – the rest of your income is taxed at the previous bracket’s rates.

The average tax rate is the sum of the calculated income taxes at each bracket divided by the total income and is more indicative of the relative amount of tax paid.

RRSP contributions can give you a tax refund because they reduce your pre-tax income that’s used in income tax calculations. If your employer deducts income taxes before they pay you (normally they do) and you make a contribution, then the calculated pre-tax income on your tax return will be less than what they’ve used in their calculation and result in the government owing you money in the form of a tax refund.

-

These calculations are simply illustrations and do not take into account things like the basic personal amount or any other credits. They’re meant to show you the math behind calculating income tax based on bracketed tax rates. I’m not an accountant or tax advisor and for what’s it’s worth – the calculations don’t match any of the income tax calculators online (not sure what I missed here). However, the method and figures are correct when using only the tax rates listed in the post. ↩︎

-

Technically a refund is the government returning money you’ve overpaid to them. It may seem like a windfall (unexpected additional money) but it’s still part of your income – they’re not giving you any additional money, it’s always been yours. ↩︎

Categories

| personal-finance

Tags

| taxes

| tax-brackets

| tax-refund

| rrsp